2025 was a challenging year for nonprofits and yet one that reminds us of the power of generosity. Shifts in federal funding and policy required many to adapt quickly. And while Americans remain concerned about the economy, we saw a slight cooling of inflation and booked our first $1 trillion holiday shopping season.

JGA has seen fundraising campaigns break records this year, while at the same time hearing from our partners that they are feeling significant pressure on donor counts and overall participation. As we’ve shared before, it’s crucial to focus on your most engaged donors during times of change.

Here’s a breakdown of some other key trends that will impact fundraising in 2026.

1. The wealth transfer continues, and even with inflation, predictors of giving remain strong.

Numerous research centers have updated the estimate of the total wealth that will be transferred from Baby Boomers to subsequent generations, and the amount could be as high as $124 trillion. To put it in perspective, this is nearly 17 times the total US government’s annual budget. Data from previous wealth transfers leads us to believe that six percent or more of this wealth will be directed to charities.

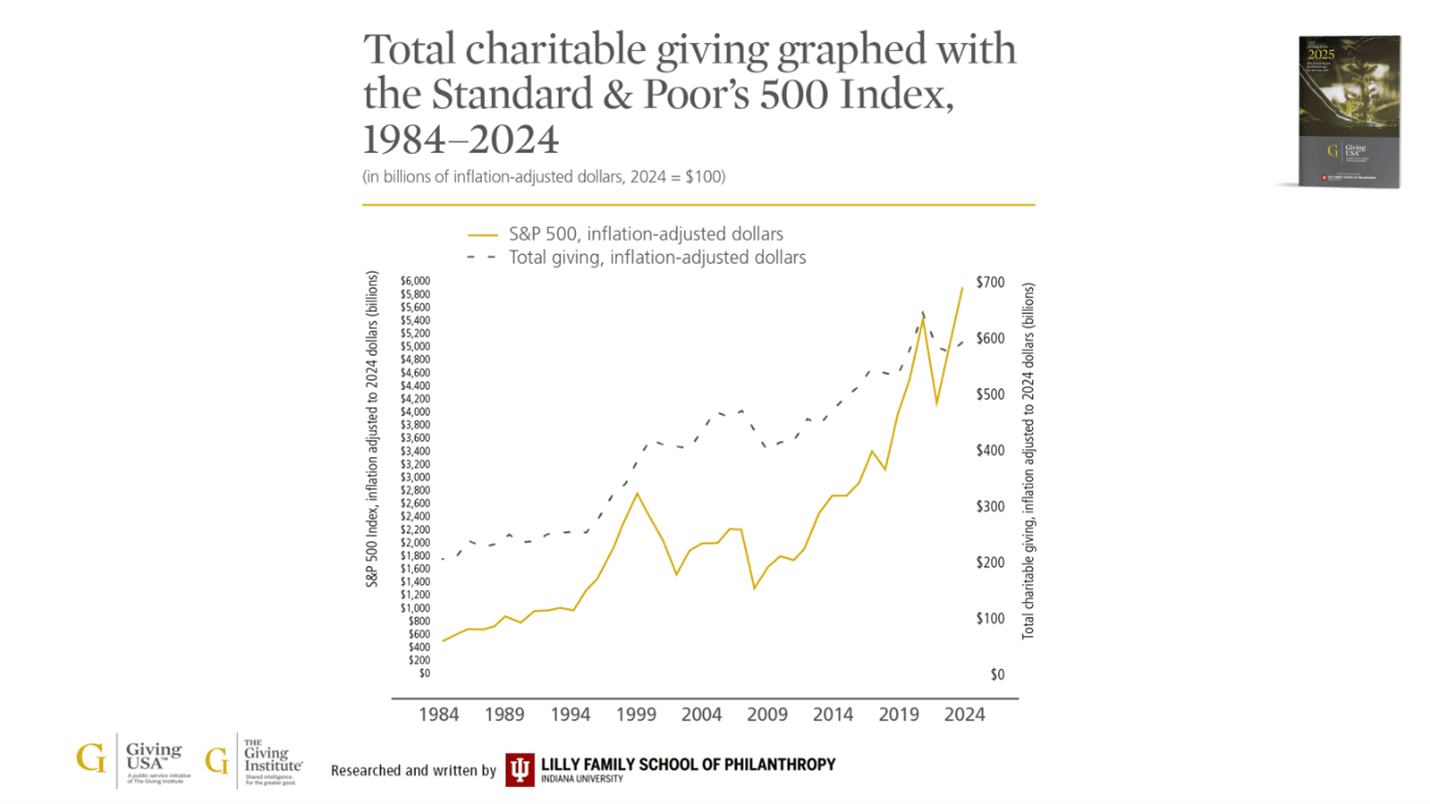

The massive transfer is combined with extremely strong giving indicators. One of the best predictors of charitable giving is the trajectory of the S+P Index during the latter part of the year, per Giving USA.

Stock prices are a big predictor of giving, as this graph from Giving USA shows.

With the S+P increasing by about nine percent over the last six months, we expect to see another record for giving when data is released later this year. JGA is a proud annual sponsor of Giving USA, and we’ll share the results in late June when they are released.

It’s important to recognize that this massive wealth transfer and boost in stock portfolios are not a future event—this is happening right now, and the nonprofits who are present and engaging high-net-worth families immediately will see the greatest success in the coming years as this massive economic shift unfolds.

2. New tax law changes will impact giving in 2026.

Significant tax law changes activate this year, including a non-itemizer universal charitable deduction of $1,000 or $2,000. There are also changes to the way charitable deductions are calculated for itemizers (including both a floor and ceiling for itemized deductions), incentives to give to K-12 scholarship granting institutions, and other changes. These changes incentivize direct contributions to organizations. It’s a good idea to stay updated on them and be ready to help donors navigate the changes.

Opinions are mixed on how these laws will impact future giving. The universal deduction is a welcome incentive after the increase in standard deduction caused fewer donors to itemize in recent years. It should help incentivize annual giving-level donors and nonprofits should market it in appeals. Other incentives will also likely help, but this first year will be a recalibration period for larger donors as they work with their financial advisors to craft the best strategy. We recommend that you mention new tax laws, stay as flexible as you can with donors on pledge payment timing, and as always, focus on your mission, the donor’s passion, and relationship-building.

3. Donors are increasingly strategic in giving to nonprofits.

The number one word we can use to describe today’s biggest givers is “strategic.” Donors are increasingly using giving vehicles like donor-advised funds (which have passed $300B and continue to grow), family foundations, and other strategic giving methods. The big trend here is that a fundraiser is no longer the primary prompter of giving but rather a partner. We view this as a positive development since donor-driven strategies are closely tied to increased giving. It’s important for fundraisers to embrace this strategic thinking and work with donors as partners.

4. High-net-worth donors are inspired by purpose, not the ask.

Bank of America’s 2025 Study of Philanthropy, in partnership with our friends at the Indiana University Lilly Family School of Philanthropy, once again provided some illuminating information on the most capable givers in the US. Large donors volunteer at an exceptionally high rate and are motivated by making a difference in the world.

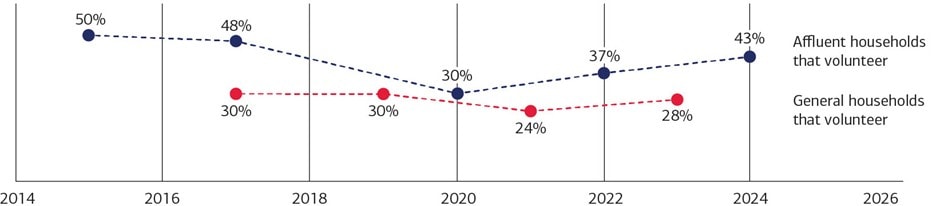

Affluent households volunteer at a significantly higher rate than the general population. Source: Bank of America 2025 Study of Philanthropy

As we reported as part of our work with The Generosity Commission, the volunteering rate decline we saw at the turn of the decade was a warning to fundraisers, because research shows that volunteering is highly tied to giving and a key way that donors express their values. The rebound apparent here is a good sign, and the fact that the rebound is even stronger with affluent givers is encouraging.

The motivation for giving by high-net-worth donors is a combination of their values and perceived ability to make a difference. In these studies, more than three-quarters of affluent donors indicate personal satisfaction as a motivator, and they consistently rate “being asked” as the lowest motivator.

What does this mean for fundraisers? We must focus on communicating the impact for giving, making giving easy and joyful. This relationship focus has been at the core of consulting strategy for three decades, and we’re happy to see our instincts confirmed in the research.

5. The American donor base is diversifying, and it’s time for fundraising to adapt.

As we’ve shared previously, women donors, donors of color, and Gen X and Gen Alpha donors are increasing in influence and making giving more inclusive every day. Research tells us that the next generation of philanthropists will be strategic, impact-driven, and collaborative. Today’s donors don’t give out of a sense of obligation; they are active partners in making a difference. This is a positive shift, allowing us to focus on the joy of giving and impact.

JGA is watching these trends unfold, and we’re ready to help your organization adapt to best engage donors that can make a difference now for your mission. Email us today, and we’ll find time to talk about your strategy, and how you can be at the table as the most generous period in history unfolds.